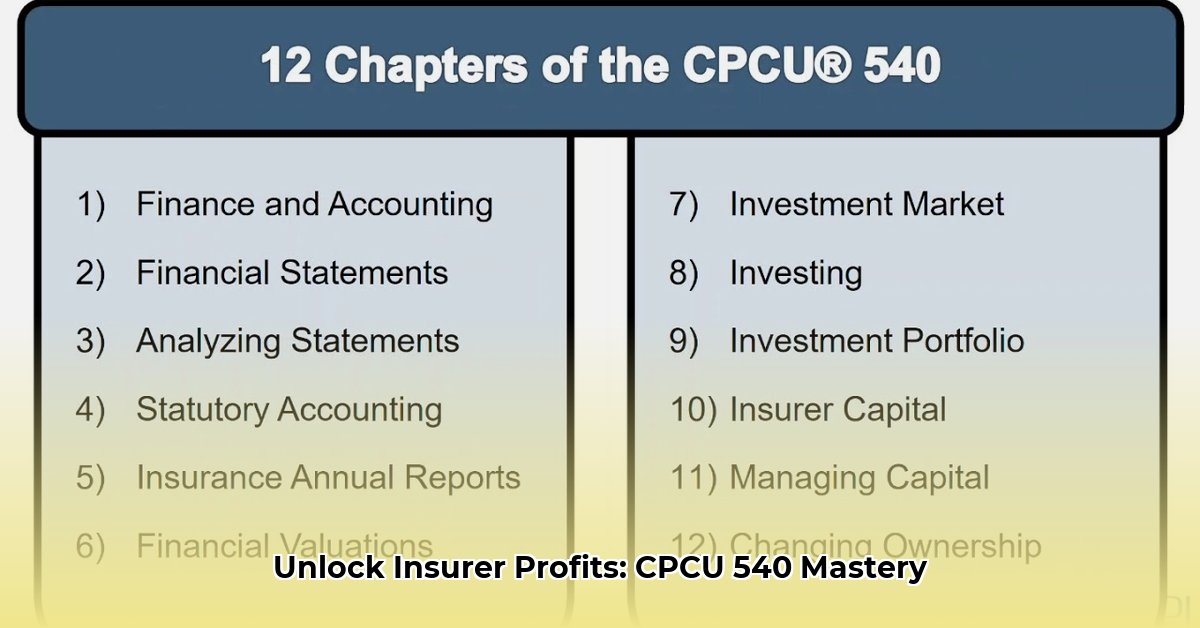

CPCU 540: Unlocking Profitability in Insurance Finance

This instructional guide leverages the core principles of CPCU 540 to provide practical strategies for enhancing insurance company profitability. We'll move beyond theoretical concepts, focusing on actionable steps and real-world applications to improve your company's financial health. For more information on CPCU courses, visit the CPCU 500 course page.

Understanding Your Insurance Company's Financial Health: A Deep Dive

Analyzing financial statements—profit and loss statements, balance sheets, and cash flow statements—is the cornerstone of sound financial management. CPCU 540 equips you with the skills to go beyond surface-level understanding and uncover critical insights. By analyzing trends, identifying potential risks, and recognizing hidden opportunities, you can optimize your company's financial performance. This isn't simply about reviewing past performance; it's about using that data to predict future trends and shape a more profitable future. Do your current processes allow for this level of insight?

Key Metrics: Focus on key performance indicators (KPIs) like the combined ratio (losses and expenses divided by earned premiums), loss ratios, and expense ratios. A lower combined ratio generally signals higher profitability. Are you tracking these metrics effectively?

Mastering Financial Ratios and Calculations: Your Strategic Advantage

Financial ratios act as a magnifying glass, enabling you to pinpoint crucial areas within your company's financial structure. CPCU 540 teaches the interpretation and practical application of these ratios, empowering you to make data-driven decisions. Understanding these ratios—and their interrelationships—is vital for strategic planning and decision-making. Are your financial analysts proficient in interpreting and applying these crucial metrics?

Example: A rising combined ratio might indicate a need for adjustments to pricing strategies or underwriting policies. By analyzing this trend, you can proactively implement changes to improve profitability.

Optimizing Investment Strategies for Enhanced Returns

Strategic investment management significantly impacts long-term profitability. CPCU 540 provides a framework for creating and executing investment plans specifically tailored to the insurance industry. This involves understanding risk tolerance, diversifying investments, and maximizing returns while managing risk.

Actionable Steps:

- Diversification: Spread investments across various asset classes to mitigate risk.

- Asset Allocation: Carefully balance investments based on risk appetite, regulatory requirements, and long-term goals.

- Regular Review: Continuously monitor and adjust your investment strategy based on market conditions and company performance. Are you regularly reviewing and updating your investment strategies?

Actionable Strategies for Key Stakeholders

CPCU 540 empowers various roles within an insurance company. Here's how they can leverage this knowledge:

1. Insurance Executives:

- Short-Term: Implement a company-wide CPCU 540 training program to enhance financial literacy. Prioritize data-driven decision-making processes.

- Long-Term: Establish a dedicated data analytics team. Develop and consistently monitor key performance indicators (KPIs) to track progress and inform strategic decisions.

2. Financial Analysts:

- Short-Term: Conduct in-depth financial statement analysis to identify areas for improvement. Create and distribute reports that inform immediate strategies.

- Long-Term: Develop predictive financial models for improved forecasting accuracy. Master advanced financial modeling techniques to enhance risk assessment and profitability projections.

3. Investment Managers:

- Short-Term: Conduct a comprehensive review of the existing investment portfolio to assess diversification and performance.

- Long-Term: Explore alternative investment options to enhance returns. Develop robust, long-term investment strategies aligned with the company's overall risk profile.

4. Actuaries:

- Short-Term: Refine risk assessment models using updated data. Improve pricing models to reflect current market conditions and risk assessments.

- Long-Term: Integrate emerging risks into pricing models for more accurate risk transfer mechanisms. Create sophisticated risk management strategies to better protect the company's financial stability.

Continuous Improvement: The Key to Long-Term Success

The benefits of CPCU 540 extend beyond the initial training. Continuous learning, data analysis, and adaptation to evolving market conditions are critical for sustained profitability. The insurance industry is dynamic; continuous professional development is non-negotiable. Are you committed to ongoing learning and adaptation within your team?

Dynamic Financial Analysis (DFA): Integrating real-time data, predictive modeling, and scenario planning provides a dynamic view of your firm's financial health, enabling proactive adaptation rather than reactive problem-solving.

Leveraging Technology for Enhanced Efficiency and Profitability

Integrating AI and Machine Learning can significantly enhance efficiency and profitability across various aspects of insurance operations.

- Predictive Underwriting: Use data to more accurately assess risk profiles and establish premiums.

- Fraud Detection: Develop advanced systems to identify and prevent fraudulent claims, protecting your company's bottom line.

- Customer Relationship Management: Improve customer service and loyalty using data-driven insights.

Investing in technology is an investment in efficiency and future profitability.

Risk Management: A Proactive Approach to Financial Stability

Effective risk management is not about avoiding risk, but about understanding, assessing, and mitigating it. This involves:

- Catastrophe Modeling: Accurately assess the potential financial impact of catastrophic events.

- Reinsurance: Implement strategies to transfer a portion of your risk to a reinsurer, thus protecting your company's financial reserves.

- Regulatory Compliance: Ensure your company adheres to all relevant regulations to avoid costly penalties and maintain a strong reputation.

A proactive risk management approach is paramount for ensuring long-term financial stability and success.